Get the free fillable hud 1 form

Get, Create, Make and Sign

Editing hud 1 form online

How to fill out hud 1 form

How to fill out the HUD 1 form:

Who needs the HUD 1 form:

Instructions and Help about hud 1 form

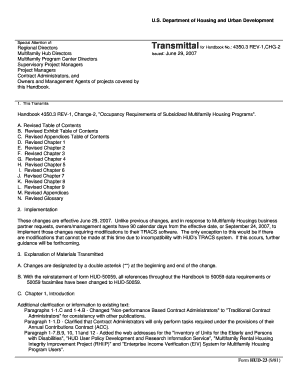

At the closing on the purchase of your home you'll be required to sign what seems like an endless number of closing documents most of these documents are standard and required to be signed by buyers in every jurisdiction we at Paragon title specialize not only in the preparation of this multitude of papers but also in doing everything we can to ensure that you understand exactly what they mean one of the most important documents is the settlement statement a summary of all the charges associated with the purchase of your new home this video will walk you through the settlement statement and explain line by line all the charges that one might have to pay based on a hypothetical transaction for a home purchase in Montgomery County Maryland if a buyer was purchasing a home in the District of Columbia or Virginia some of the charges that would be assessed would be different however most of the concepts and explanations are very much the same now let's start with line 303 of the settlement statement on this line you see the total amount due at closing of $120170011.97 based upon our hypothetical this amount is calculated by adding together the balance of your down payment plus your closing costs the sales contract requires you to pay this balance with either a cashier's or certified check or wired funds now let's take a closer look at how these closing costs were derived the details of your closing costs start on page two while the settlement statement breaks down the buyers and the sellers' transaction in this video were focusing solely on the buyers expenses shown in the left-hand column of the settlement statement near the top of the page line 703 is the administrative portion of the Commission that the buyer agreed to pay in the buyer broker agreement lines 801 through 803 show your loan origination charges this is what the lender charges you to originate your loan in this instance the fee is one percent of your loan amount plus two hundred and fifty dollars for processing this fee would have been disclosed to you along with all the other closing costs in the good faith estimate from your lender additional lender charges of $400 for the Hazel and $80 for the credit report are shown on lines 804 and 805 but also say POC beside them POC means that these fees were paid outside of closing and are not included in the total of settlement costs nor the total amount due as shown on 303 of this statement they are listed only for record-keeping purposes the tax service fee listed on line 806 is a one-time charge to set up an account held by the lender to pay your annual property taxes this concept will be explained more in detail later in this video line 807 the flood certification is a one-time fee collected by your lender to get an assurance that your new home is not located in a flood zone prepaid interest on your loan is defined on line 901 in this example the settlement is taking place on November 1st 2012 the first mortgage payment will not be due...

Fill form : Try Risk Free

People Also Ask about hud 1 form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your hud 1 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.